Your Home Value, Equity, and Refi Options only 10 seconds away

Type Your address below to get started

Immediate Benefits

Accurate Home Appraisal

Loan Balance Settlement

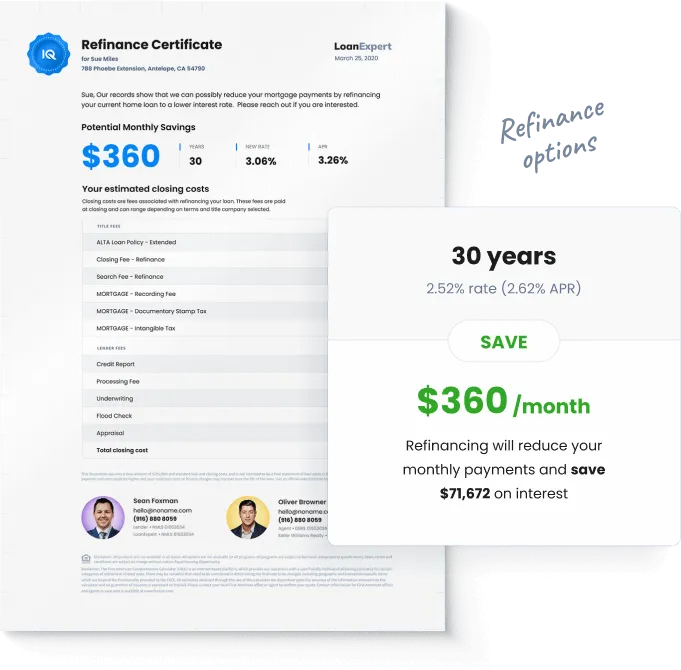

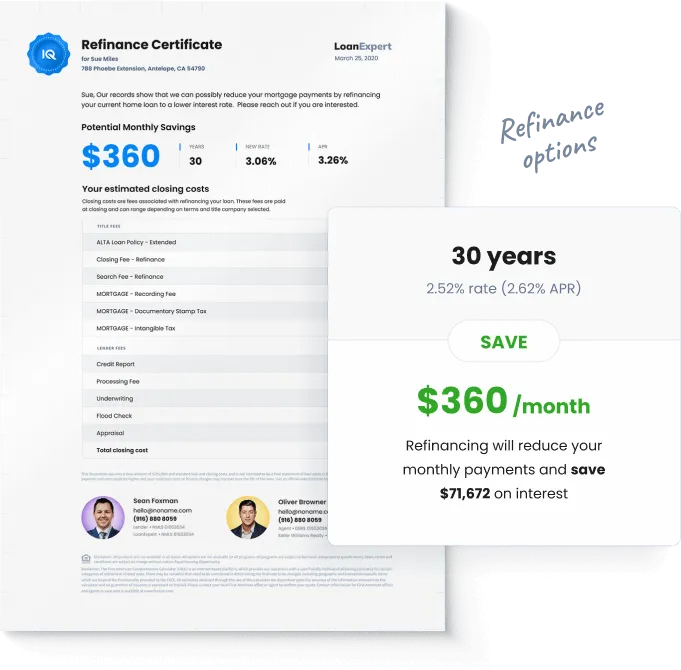

Immediate Refinancing Solutions

Mortgage Insurance Evaluation

Equity Availability for Cash-Out

Frequently Asked Questions

What Does AVM Stand For?

AVM stands for Automated Valuation Model. It’s a technology-driven method that analyzes various public records and historical sales data to estimate a property’s value.

How Reliable Are AVMs?

Generally, AVMs, especially those on a national level, may not accurately reflect the true value of a home due to their significant error margin. These models rely on automated calculations from public data and often miss out on the specific characteristics and local market conditions that can impact a home’s actual worth.

What's the Best Way to Get an Accurate Home Value Estimate?

To obtain a more precise valuation of your home, we recommend requesting a Comparative Market Analysis (CMA) from our team. Our personalized CMA provides a comprehensive overview of market movements, competitive listings, and recent sales in your locality, offering a clearer picture of your property’s value.

Can You Explain What a Comparative Market Analysis (CMA) Entails?

A Comparative Market Analysis, or CMA, is a custom report prepared by our experienced agents. It involves a detailed comparison of your home with similar properties in your area that are either on the market or have been sold recently. This analysis takes into account various factors such as market trends, location, and unique features of your home like its condition and amenities. This tailored approach enables our agents to provide you with a well-informed estimation of your home’s market value.

The Importance of Your Home's Value

For many individuals, a home constitutes their primary asset, making up more than 80% of their wealth upon retirement. Obtaining an accurate home valuation is essential should you consider selling, refinancing, or tapping into your home's equity.

Receive A Detailed MyHomeIQ Report

Instantly obtain a comprehensive home analysis report to grasp all your options as a homeowner, including the actual expenses associated with selling a home in today's market.

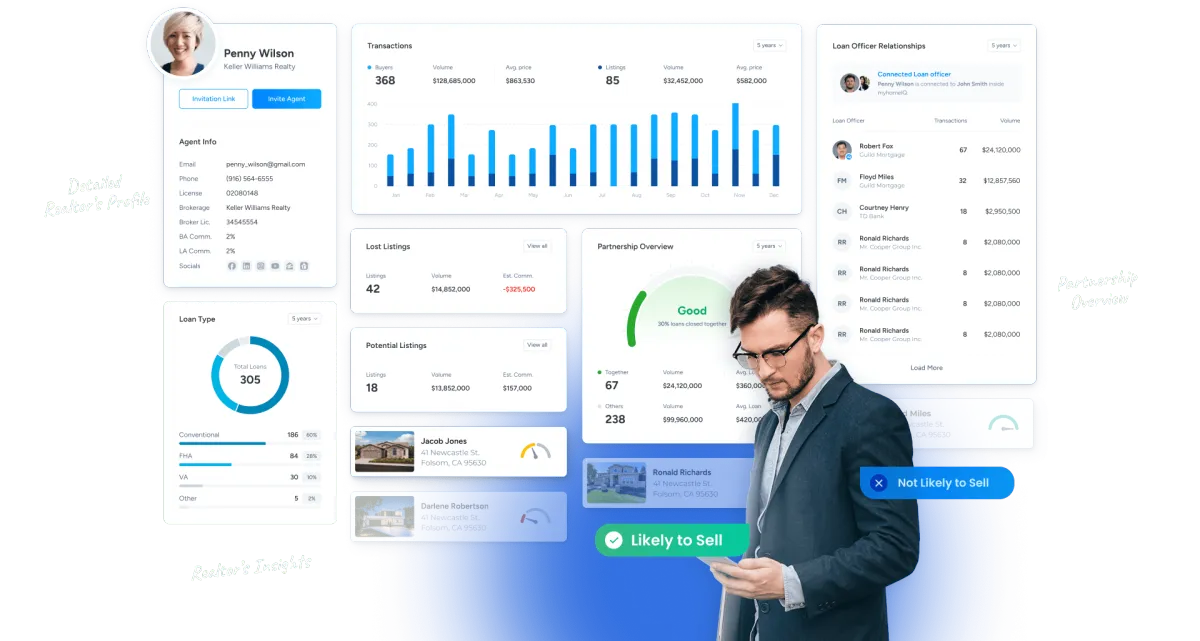

Access Your My Home IQ Dashboard

Gain complimentary access to your customized myHomeIQ portal and stay updated on any modifications to your home that can assist you in building your wealth.

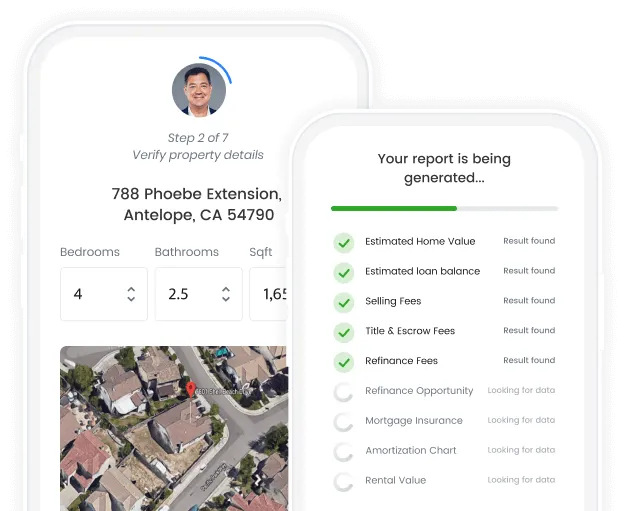

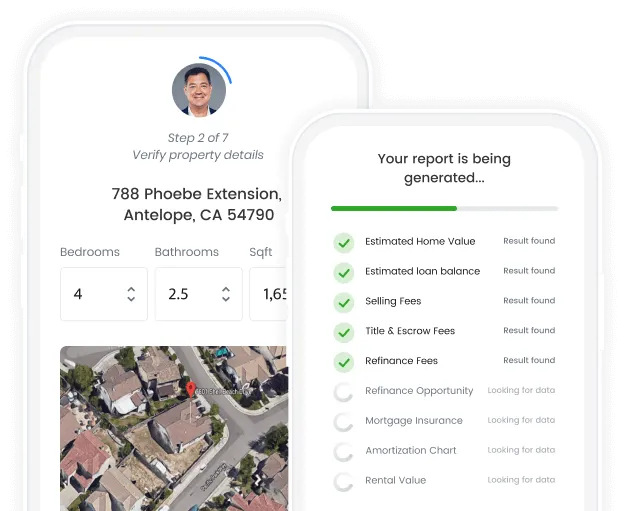

Complete 7 simple questions

Our online algorithms can provide a significantly more precise estimation of your home's current value by aggregating market data from various reputable sources and linking you with a licensed Realtor to validate its accuracy.

There is no obligation at all

1. Find your location

Please provide your address so we can analyze your home value and loan information.

2. Verify your identity

Confirm your current loan details to ensure an accurate report

3. Instantly Receive The Report

Access a PDF report and gain unlimited entry to an online home portal

What are you holding out for?

Receive your home value and equity report within a minute.

Why the Value of Your Home Is Significant

Outside of providing a place for your family to live, your home is an important part of your financial plan, too.

Here’s why it matters:

Value as an Investment:

Over time, your home should theoretically appreciate in value. As your home's value grows, so does your net worth. If you decide to sell your home in the future, you stand to profit from your investment.

Resale value:

"If you're nearing the 3-year mark before selling your home, it's advisable to monitor its value and the real estate market closely, aiming to capitalize on selling at an opportune moment," advises Jose V. Sanchez, financial advisor and contributor to life insurance toolkit.

Leveraging power:

This is particularly relevant if you find yourself needing to borrow against the value of your home. With a substantial increase in your home's value, you'll have greater flexibility in obtaining a home equity line of credit (HELOC) to cover expenses such as renovations, purchasing a car, or funding your children's education.

Legacy planning:

Ultimately, being aware of your home's value can be crucial for estate and elder law care planning too, emphasizes Joseph A. Carbone, Jr., CFP, Founder, and Wealth Advisor of Focus Planning Group.

Tax implications:

"Monitoring both the market value and property tax assessment value is crucial to avoid inadvertently paying taxes on a property value that's artificially inflated or, conversely, undervalued," advises Minnesota Financial Advisor Jamie Pomeroy.

Home coverage:

Don't underestimate the importance of understanding your home's value in ensuring you have adequate coverage with your homeowners insurance.

Get in touch with a real estate expert

Whether you seek a friendly conversation or require further details,

our licensed real estate professional is prepared to assist you.

Tiffany Lucas

Broker | DRE 5426

Lucas Ladies of EXP Realty | DRE 5426